STOP BUILDING YOUR LANDLORD'S WEALTH

Start Building Your Own in the Bay Area

The Bay Area Homeowner Advantage

Every month you rent is another month of building someone else's wealth instead of your own. Here's why Bay Area buyers consistently win in the long term.

Build Equity, Not Your Landlord's

Every mortgage payment builds your net worth. In the Bay Area's appreciating market, you're not just paying for housing, your making a strategic investment while renters pay off someone else's mortgage with zero return.

Bay Area Appreciation Advantage

Bay Area properties have consistently outperformed national averages. While renters face annual increases with no benefit, homeowners build wealth through property value appreciation that often exceeds their monthly payments.

Fixed Housing Costs

Lock in your housing costs with a fixed-rate mortgage. While your neighbors face 5-10% annual rent increases, your principal and interst payments remain stable for 30 years, providing predictable budgeting.

Significant Tax Advantage

Mortgage interest deductions, property tax deductions, and capital gains exclusions on your primary residence. The tax code rewards homeowners, renters receive no tax benefits for housing costs.

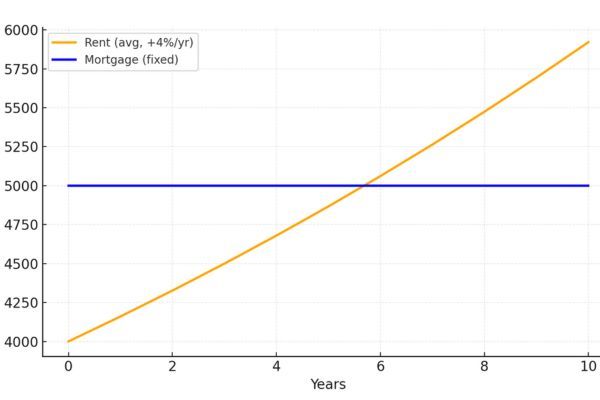

Rent vs Mortgage over 10 Years

Based on current Bay Area market conditions: $5,000 monthly mortgage vs $4,000 starting rent with 5% annual increases. In about 5 years, average rent surpasses a $5,000/month mortgage.